With the implementation of Trump Tariffs 2025, eCommerce companies face a new era of uncertainty. Having to deal with rising import duties on a wide range of goods, online retail supply chains are facing major challenges. Previously, in 2018, the wave of tariffs impacted Chinese goods significantly, driving up costs across industries. Trump's 2025 Tariffs impact on eCommerce brands have followed a similar trend.

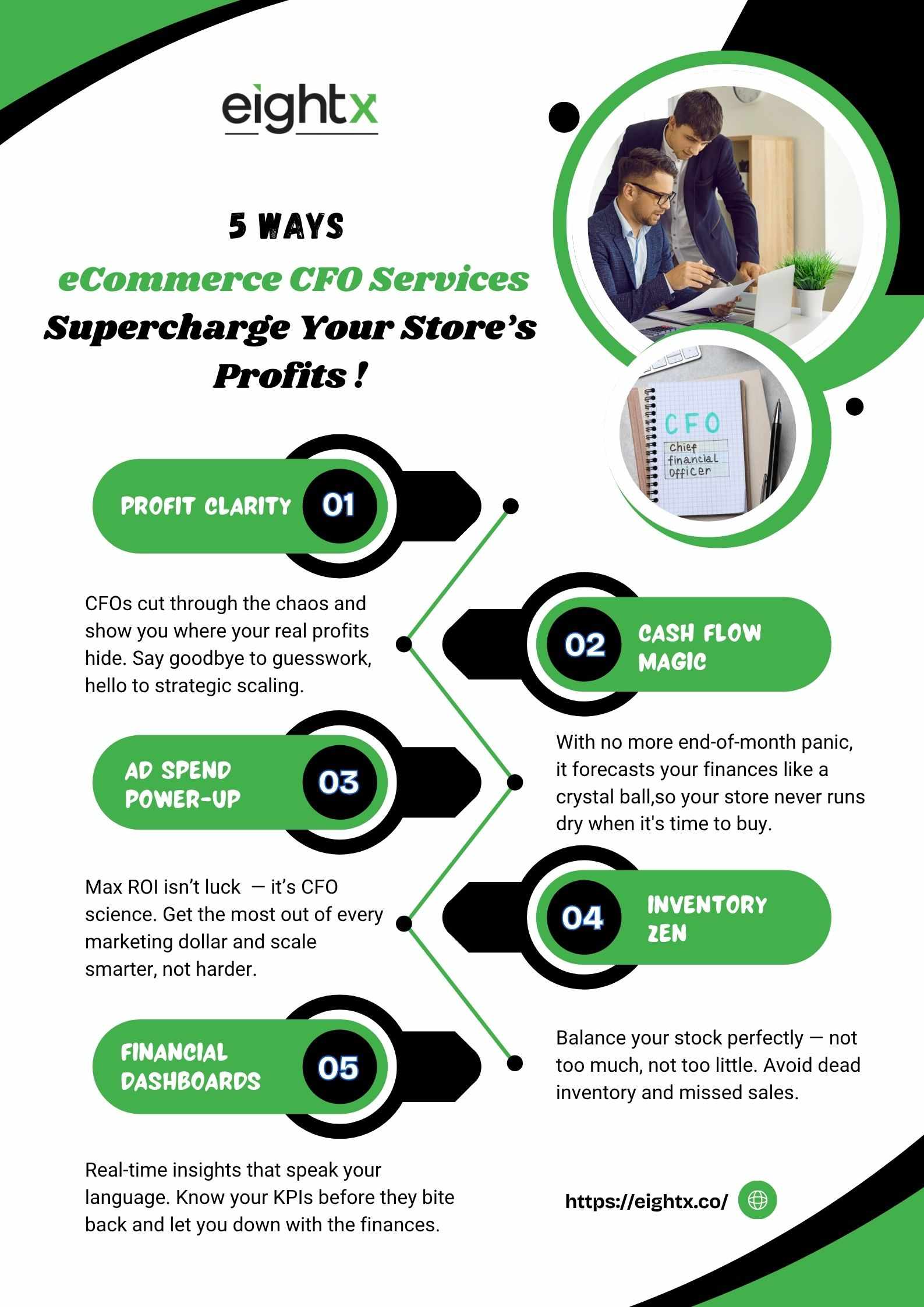

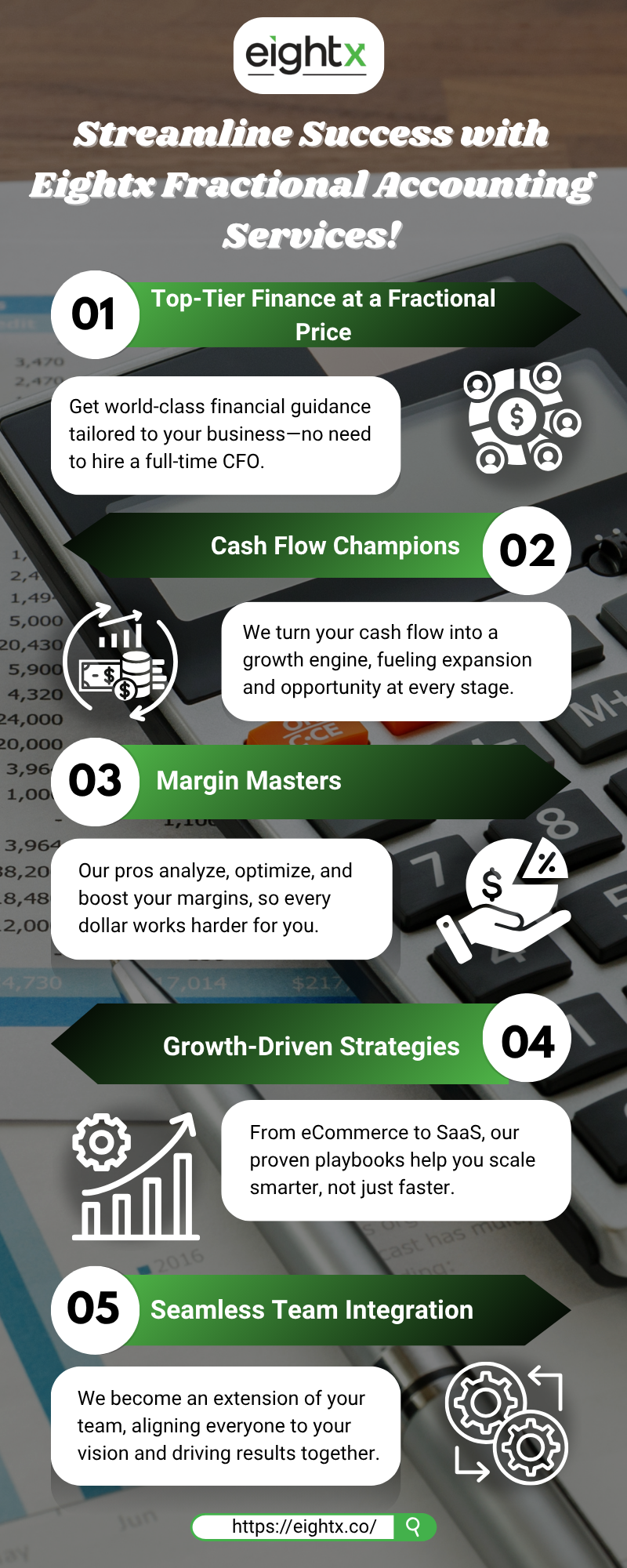

For eCommerce brands relying on international suppliers, now is the time to take action. Strategic financial planning, especially with the help of fractional CFO services, can help cushion the blow. From scenario modeling to optimizing supply chain costs, a strong financial partner can help you adapt and scale even under tariff pressure.

Understanding the 2025 eCommerce Tariffs Landscape

Trump Tariffs 2025 are currently affecting imports from countries like China, Vietnam, and Mexico, all key manufacturing hubs for eCommerce products. Categories that are being hit hardest include:

Consumer electronics

Apparel and accessories

Home goods and decor

Beauty and personal care

Current Implementation Status:

Announced: April 2, 2025

Initial Implementation: April 5, 2025 (10% on all countries)

Chinese Goods Increase: March 4, 2025 (increased from 10% to 20%)

Additional Electronics Tariffs: April 2025 (smartphones, computers added)

Retailers on platforms like Amazon, Etsy, and Shopify are already voicing concern. These increased costs won't just affect sourcing. They'll impact margins, shipping fees, and ultimately customer pricing.

How eCommerce CFO Services Help Navigate Tariff Disruptions

A fractional CFO for eCommerce isn't just a financial advisor. They are your strategic ally in times of volatility. Tariffs bring ripple effects across your business and eCommerce CFO services help you pivot faster.

Here's how:

Margin Preservation: Analyze each product line to assess margin risk under new tariffs

Repricing Strategies: Reconfigure pricing across platforms to offset new costs without sacrificing customer retention

Real-Time Cash Flow Modeling: Project how increased import costs will affect cash reserves, debt coverage, and operating runway

Instead of reactive decisions, you gain proactive control. That's something your accountant or bookkeeper typically can't deliver.

Strategic Forecasting and Scenario Planning with Fractional CFO Consulting Services

Preparing for tariffs means expecting the unexpected. This is where Fractional CFO Consulting Services shine. By developing multiple financial scenarios, you can simulate how different tariff outcomes will affect your bottom line.

A seasoned CFO will:

Build best-case, mid-case, and worst-case models

Prepare your team for investor questions and board discussions

Use forecasting tools to model tariff costs per SKU, region, and fulfillment method

Companies that use financial scenario planning during supply chain disruptions typically recover faster than those that don't.

Reassessing Ad Spend, CAC, and Pricing Strategies

Tariffs eat into margins, which means every dollar spent needs to yield more. That includes your marketing.

Your CFO can guide:

Updated CAC-to-LTV modeling based on rising fulfillment and COGS (Cost of Goods Sold)

Identification of unprofitable acquisition channels

Strategies to raise prices subtly without hurting conversion rates

eCommerce CFO services give you performance dashboards and ROI metrics that help you fine-tune ad spend rather than blindly cut it.

Tax Compliance, Trade Rules, and Risk Management

With new tariffs often come new rules, audits, and compliance checks. A fractional CFO helps reduce exposure by ensuring your business is ready.

Key responsibilities include:

Ensuring your compliance with import and export documentation

Monitoring tariff codes and updating product classifications

Advising on sales tax exposure across states and countries

This layer of oversight also includes identifying fraud risks, managing advance payments, and helping you prepare financially for tighter regulations. A proactive approach to compliance can save you from expensive surprises.

Why You Need Fractional CFO Services in 2025, Not Just a Bookkeeper

Trump's 2025 Tariffs impact eCommerce brands in multiple ways, affecting strategy, execution, and long-term growth. That is where the distinction between bookkeeping and strategic leadership becomes critical.

Bookkeepers track. CFOs forecast and advise

CFOs help drive investor confidence, improve profitability, and prepare for exits

Part-time CFOs offer flexible, high-level support without full-time costs

Whether you're planning to raise a Series A or aiming for a future exit, fractional CFO for e-commerce services help you think beyond spreadsheets and toward real growth.

Conclusion: Scale Smarter, Not Slower in a Tariff-Challenged Economy

Trump Tariffs 2025 are a wake-up call for eCommerce brands. Rising costs, tighter margins, and new compliance requirements will challenge even the most agile operators. But for those with a plan and a strategic financial partner, this could also be an opportunity to outmaneuver competitors and scale smarter.

Eightx helps eCommerce and CPG brands navigate complexity with confidence. Through specialized Fractional CFO Consulting Services, they provide cash flow clarity, tariff-impact planning, and growth-focused financial strategy. From forecasting to fundraising, Eightx equips you to thrive in uncertain conditions.

Book your free 30-minute consultation at eightx.co and start building a tariff-proof financial strategy today.

FAQs

1. What are Trump's 2025 tariffs and how will they affect eCommerce?

Trump Tariffs 2025 are implemented duties on imported goods from countries like China and Mexico. These have raised costs on categories such as apparel, electronics, and home goods. They are directly affecting eCommerce sellers' margins, pricing, and supply chain decisions.

2. Can fractional CFO services help manage rising import costs?

Yes. Fractional CFO services can model the financial impact of tariffs, help you restructure pricing, and advise on supplier diversification. They also monitor inventory, renegotiate terms, and ensure cash flow is protected under new cost structures.

3. What's the difference between a fractional CFO and an accountant during tariff disruptions?

An accountant records financials, but a fractional CFO creates forward-looking strategies. During tariff changes, a CFO helps with forecasting, risk management, pricing strategy, and investor communication. These are responsibilities that accountants typically don't handle.

Write a comment ...