Business moves fast, especially for eCommerce and CPG brands that are pushing into new markets. Financial agility is no longer a luxury; it is a survival tool. Many leadership teams now lean on fractional CFO services to gain expert direction without the commitment of a full-time hire.

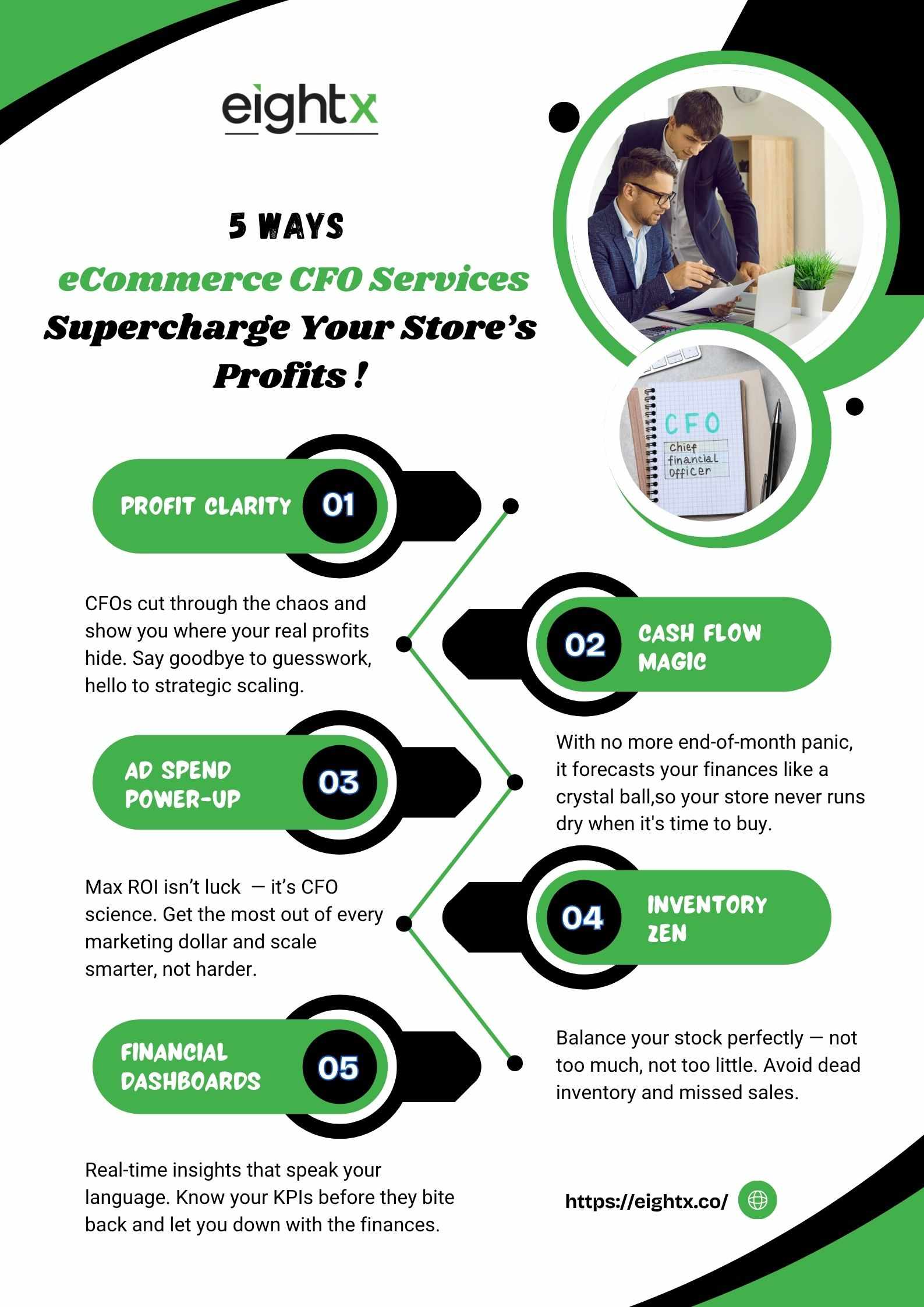

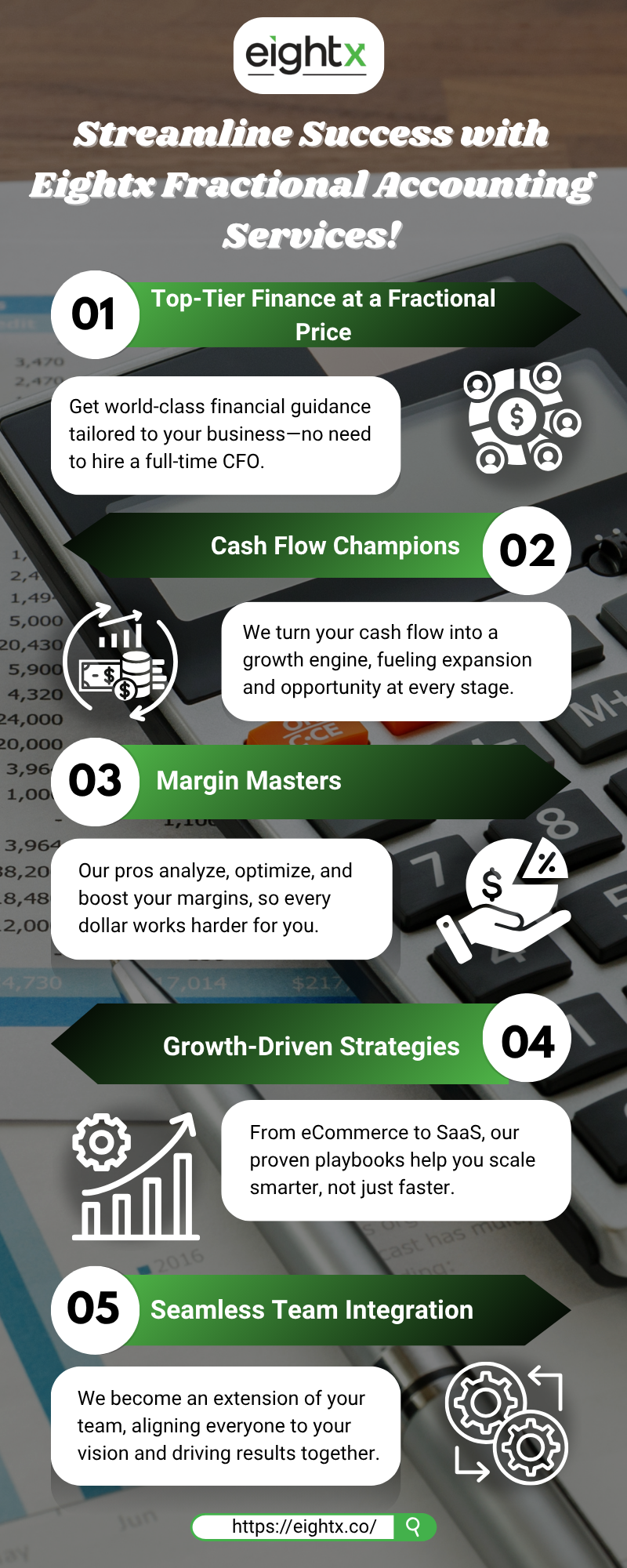

A fractional CFO is an experienced finance professional who joins the organisation on a part-time or project basis. The arrangement delivers executive insight at a fraction of the usual payroll cost, keeping cash free for growth initiatives.

In this blog, you will discover five signs that reveal when bringing in a fractional CFO makes sense, along with practical ways Eightx supports companies that choose this path.

Sign #1: You're Experiencing Rapid Growth but Lack Financial Direction

Rapid growth of an organization can quickly overwhelm your financial systems. Basic bookkeeping and standard accounting are often no match for the complexity that comes with scaling.

Without strategic financial advisory services like forecasting, cash flow management, and budgeting, businesses risk flying blind. You may face questions like:

How do we prioritize growth opportunities?

Are we overextending our resources?

Do we have enough cash to fuel expansion?

This is where fractional CFO services shine. Fractional CFO services provide a framework that pairs growth targets with realistic funding needs. A fractional CFO builds models that map inventory cycles, marketing spend, and payroll against expected receipts, guiding founders toward sustainable scale instead of guesswork. Teams gain clear priorities, investors gain confidence, and leaders avoid expensive surprises.

Sign #2: You’re Raising Capital or Planning to Fundraise

When looking to raise funds, investors expect more than just passion. They want:

Clean, accurate financials

Detailed forecasts and growth plans

A compelling, data-backed pitch

Outsource fractional CFO services can dramatically improve your fundraising success. From refining your pitch deck to preparing for due diligence, a fractional CFO will help you tell a clear financial story that resonates with investors.

They’ll also craft financial models that not only highlight upside potential but address risks proactively. This level of preparation can significantly accelerate your fundraising timeline and boost credibility.

According to a recent study, startups that engage financial advisors early raise 30% more funding than those that go it alone. With Eightx’s specialized CFO consulting services, you can be sure your capital raise is built on a rock-solid financial foundation.

Sign #3: Your Profit Margins Are Shrinking but You Don’t Know Why

Are your sales growing, but your bank balance isn’t? This is a common challenge, especially for fast-growing brands.

Without rigorous cost analysis and margin tracking, it’s easy to lose sight of unit economics. Rising expenses, from marketing spend to shipping costs can quietly erode profits.

A fractional CFO will dig deep into your numbers to uncover:

Which products or services drive the most profit

Where overhead is bloated

How pricing strategies can improve margins

For example, many eCommerce companies overspend on customer acquisition without realizing the true impact on profitability. A fractional CFO brings the financial insight needed to make data-driven decisions, optimize spending, and protect your bottom line.

Sign #4: You’re Thinking About an Exit or Acquisition

Planning an exit, merger, or acquisition? You’ll need to be deal-ready, which demands more than just a good narrative.

Buyers and investors want to see:

Clean books and accurate financials

Optimized EBITDA

Strong cash flow and margin performance

Clear documentation of historical and projected performance

Virtual CFO services can prepare your company for a successful exit by conducting financial audits, identifying areas for improvement, and supporting you through negotiations. With Eightx’s expertise in exit planning, you’ll have the tools to maximize your valuation and ensure a smooth process.

For CPG and eCommerce brands, having a CFO who understands industry benchmarks can be a game-changer when negotiating with potential acquirers or investors.

Sign #5: You’re Wasting Time on Financial Tasks Instead of Leading

As a founder or CEO, your time is best spent on vision, leadership, and growth and not buried in spreadsheets or chasing invoices.

The cost of founder time drain is real:

Delayed strategic decisions

Missed growth opportunities

Burnout and stress

By working with fractional CFO services, you free yourself from the day-to-day grind of financial management. Instead, you gain a trusted partner who handles everything from cash flow forecasting to board reporting, giving you the mental clarity to focus on what you do best.

Eightx’s CFOs specialize in aligning teams and creating the financial infrastructure that allows businesses to scale without chaos.

Ready to Transform Your Business? Here’s Why Eightx is Your Best Partner

If you recognize one (or all) of these signs, now is the time to act. A fractional CFO offers:

Strategic financial planning

Margin improvement

Fundraising support

Exit readiness

Founder time freedom

Looking for financial advisory services Canada? Partnering with Eightx brings advisors fluent in eCommerce and CPG realities. Our team excels in forecasting, budgeting, inventory stewardship, and long-range financial strategy, producing more cash on hand, healthier margins, and lower stress.

Outsource Fractional CFO Services and begin the journey toward a stronger financial outlook!

Book your free 30-minute consultation today.

FAQs

1. What does a fractional CFO do?

A fractional CFO supplies senior-level financial strategy, builds budgets, crafts forecasts, and supports key decisions on a part-time or project schedule, giving the company executive expertise without a permanent salary.

2. How can I tell whether my business needs a fractional CFO or merely a bookkeeper?

Bookkeepers record daily transactions. A fractional CFO interprets those numbers, designs forward-looking plans, and offers advisory insight that suits firms scaling quickly or facing complex financial choices.

3. What is the usual cost of a fractional CFO?

Rates change according to background and scope, yet most organisations invest between 2,000 and 10,000 dollars each month, an amount well below the salary of a full-time CFO and suitable for many growth-stage budgets.

4. Can a fractional CFO assist during fundraising and investor relations?

Yes. The CFO refines models, prepares investor materials, and organises financial records, making capital raises faster and more credible.

5. Is a fractional CFO a long-term answer or a temporary measure?

Both paths are viable. Some firms retain fractional CFOs for flexibility and cost control, while others arrange shorter engagements during growth spurts, fundraising rounds, or restructuring efforts.

Write a comment ...